This article was first published by Marsh in April 2020

M&A Snapshot

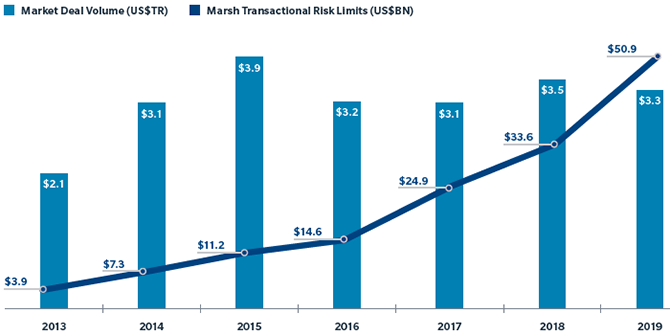

The value of global mergers and acquisitions (M&A) in 2019 was roughly US$3.3 trillion across 19,322 deals, down 6.9% from 2018 (see Figure 1). This represents the sixth consecutive year of deal values in excess of US$3 trillion, and overall deal value higher than both 2016 and 2017. Private equity (PE) buyout activity was robust, nearly matching 2018 levels, with buyouts valued at US$556

Figure 1: Global M&A value tops $3 trillion for sixth straight year

Global Trends

Transactional risk insurance includes policies that cover risks related to M&A, such as representations and warranties (R&W) insurance, or warranty and indemnity (W&I) insurance, tax insurance, and contingent liability insurance.

Transactional risk insurance limits placed globally by Marsh JLT Specialty increased in 2019 by 51% from 2018, to US$50.9 billion. These limits were spread over 1,241 closed transactions — an increase of 26% from the prior year.

Figure 2: Transactional risk insurance limits placed by Marsh JLT Specialty increased 51% year-over-year

Ěý

Regional Trends

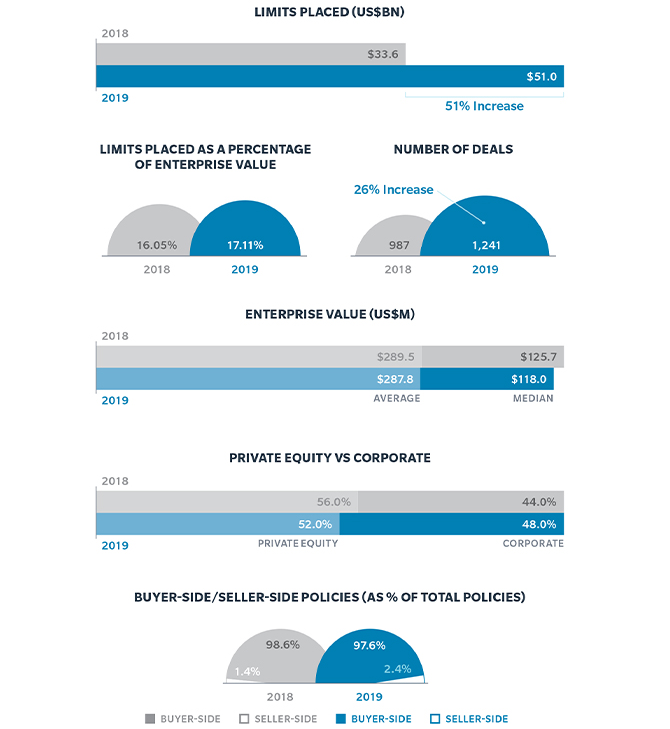

North America

In 2019, the transactional risk insurance market remained robust in North America, with insurer capacity exceeding $1 billion in limits for a single transaction and more than 20 insurers offering terms on a primary basis.

Market competition continued to drive a favorable premium rate environment for insureds though we anticipate primary layer pricing will increase slightly in 2020, resulting from adverse claims activity.

Figure 3: North American transactional risk insurance market remains robust

Latin America

While the use of transactional risk insurance in Latin America is low compared to elsewhere, there continues to be increased investor interest throughout the region.

More than 10 insurers have demonstrated some interest in providing capacity in the region however, insurer appetite is deal- and country-specific.

Premium rates typically are significantly higher than in other geographies.

Europe, Middle East & Africa

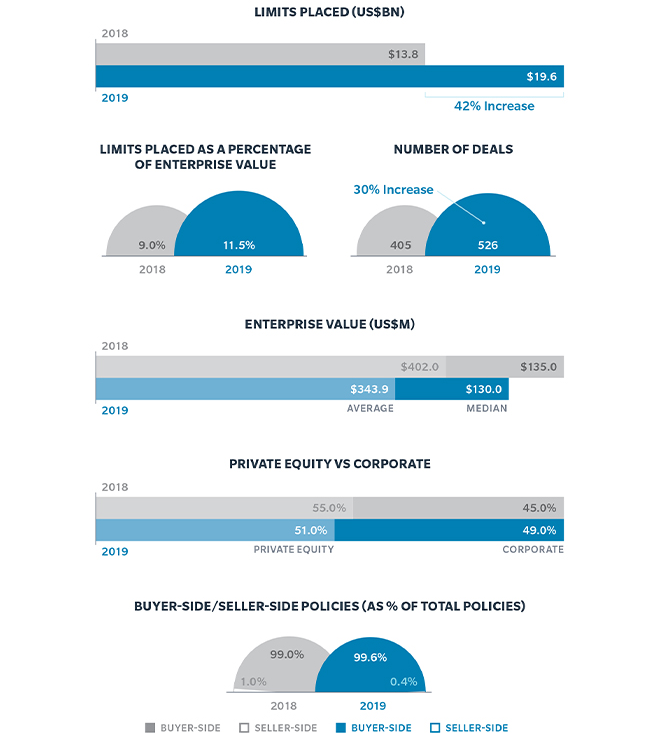

In 2019, the number of M&A deals and overall deal value in Europe decreased, although W&I insurance placed by Marsh JLT Specialty grew by about 24% over 2018.

Growth in the region is being driven by two key trends:

- The number of large deals insured — those valued at greater than $1 billion enterprise value — increased.Ěý

- A "seller friendly" M&A market is being experienced in many EMEA jurisdictions.

As the average enterprise value of transactions insured also increased, the average limit purchased was $42.8 million in 2019 ($29.9 million in 2018).

Figure 4: Deal value in EMEA decreased in 2019, though W&I placements increased.

Asia

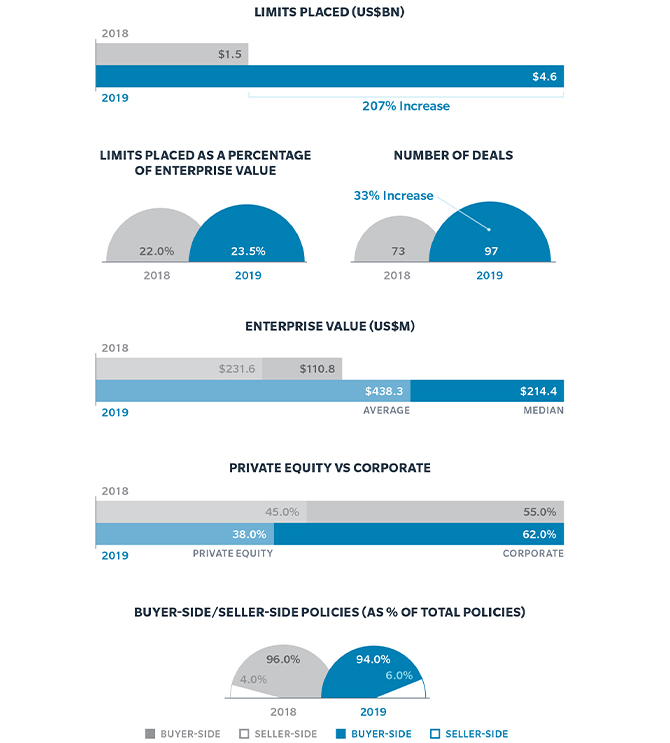

In 2019, M&A across Asia saw a marked increase in the number and size of deals and in insurance limits placed, particularly in Japan and Southeast Asia.

Overall deal count in the region in 2019 was up by 33% over 2018. At the same time, the average limits placed increased by 200% over the prior year.

Figure 5: Deal count and transactional risk insurance limits placed increased in Asia in 2019

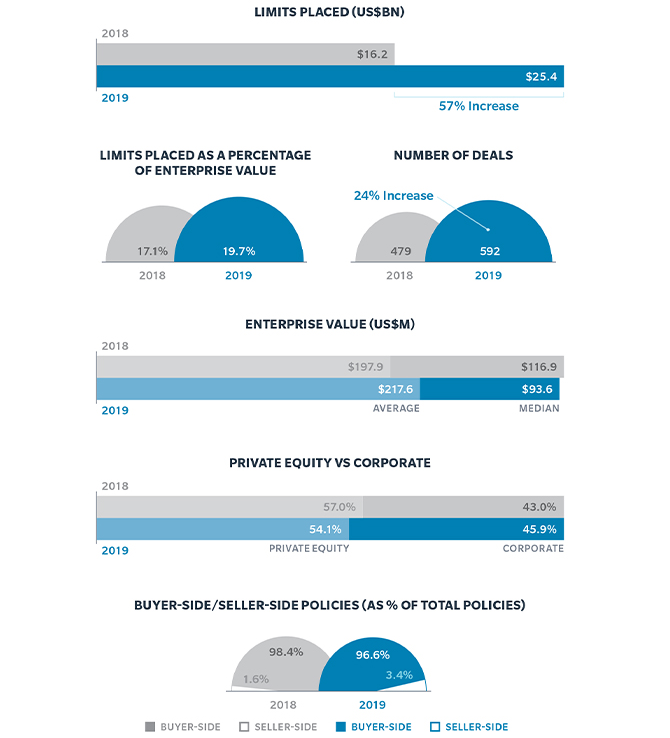

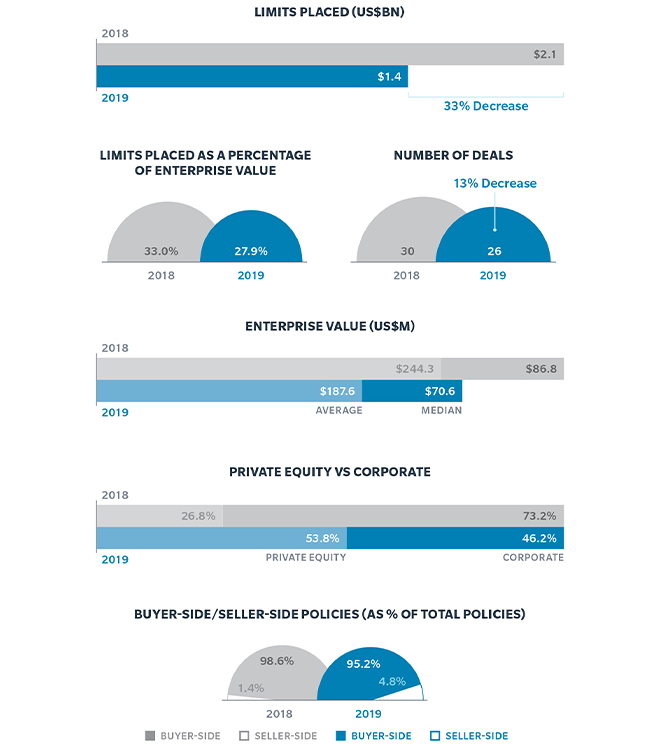

Pacific

In 2019, M&A deal value across the Pacific region decreased; however, Marsh JLT Specialty saw an increase in the number of W&I insured deals.

Despite a decrease in the deal value of domestic (approximately 58%) and inbound deals (2.3%) the average limit purchase — as a percent of enterprise value — was nearly unchanged from the prior year at 28%.

Figure 6: M&A deal value decreased in the Pacific in 2019, though the number of W&I insured deals rose.

Conclusion

Transactional risk insurance continues to be a firmly established deal solution in the M&A marketplace. In 2019, we saw an expanded use of transactional risk solutions among both smaller enterprises as well as in some of the largest deals.

Market capacity can now support limits in excess of US$1 billion and underwriting processes around transactional risk insurance have become highly refined and move at typical deal cadence, or can be accelerated based on deal timing.

Among the trends to watch are developments in claims. As companies expand their use of transactional risk products, we expect the number of claims will also increase; as this occurs, underwriting will focus increase focus on claims heavy areas.